Leasing a Farm Ute

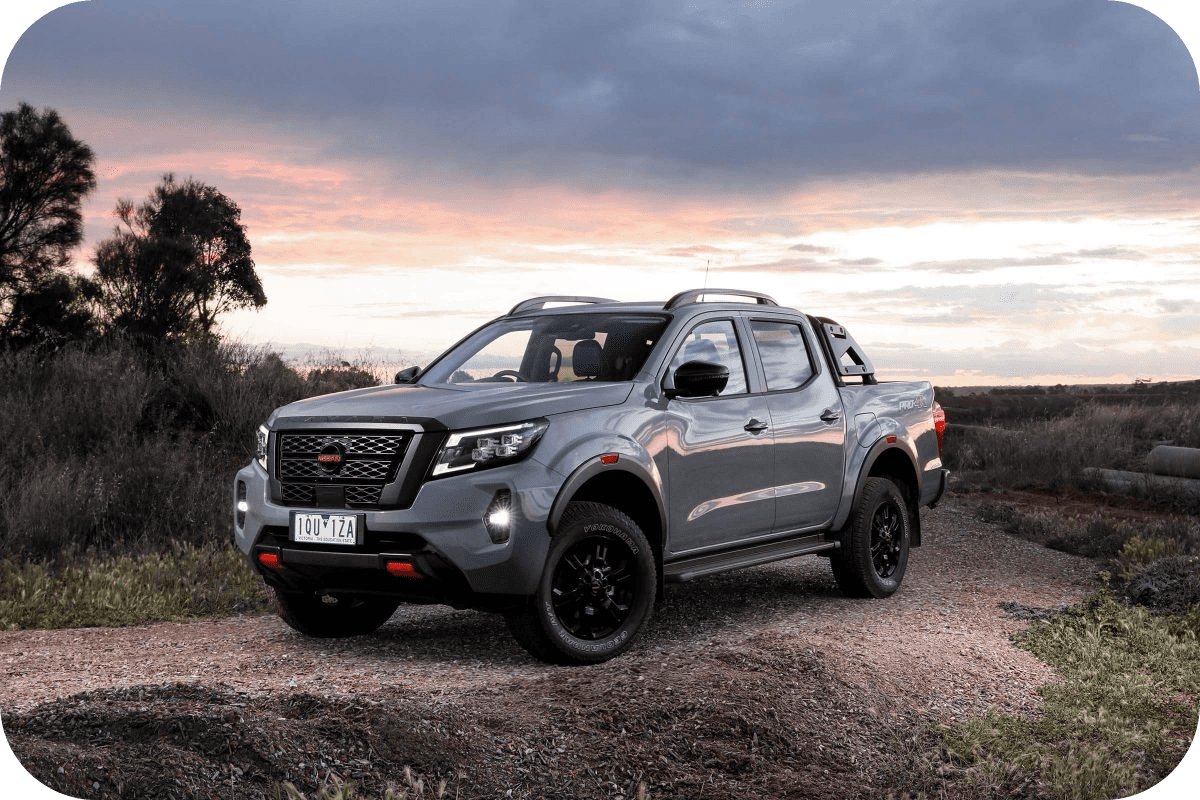

Farm Ute leasing serves as a valuable financial tool that empowers farms and businesses, particularly those in the agricultural sector, to acquire essential farm vehicles without the substantial upfront costs often associated with outright purchases.

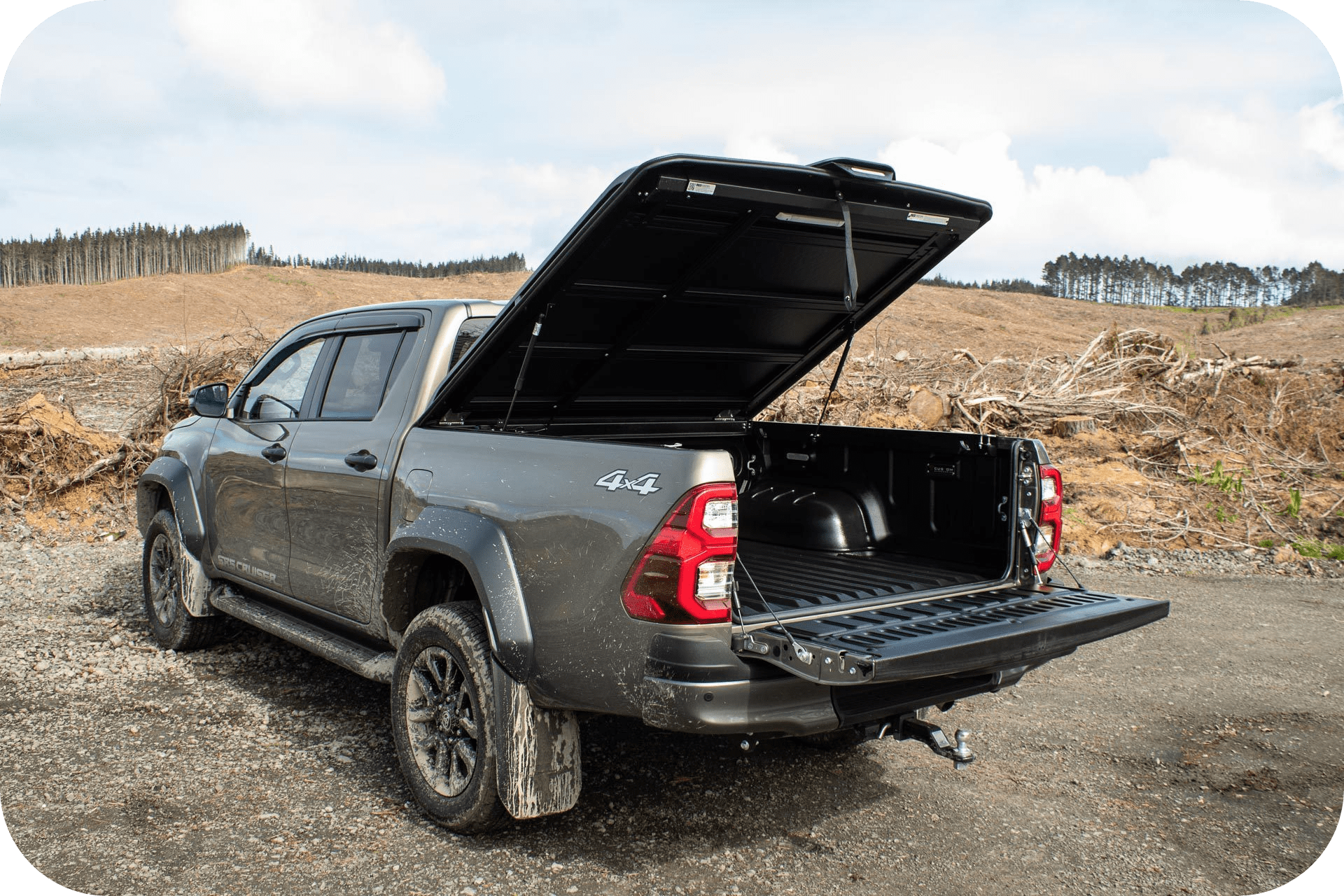

Through this arrangement, the lease company retains ownership of the vehicle while you, as the lessee, pay a predetermined monthly rental fee that allows you to use the vehicle as needed. Typically, lease periods range from three to five years and are predominantly available for new farm utes and vehicles, which are specifically designed to meet the rigorous demands of farm work.

At the conclusion of the lease term, you are required to return the vehicle to the leasing company in good condition, which ensures that it remains in a usable state for future sale. Unlike traditional hire purchase agreements where you would make payments toward the full purchase price of the vehicle, with a leasing agreement, you are only responsible for covering the cost of the time you utilize the vehicle throughout the lease period.

Leasing a Farm Ute and the options.

In addition, there is frequently an option to purchase the vehicle at the end of the lease term, should you wish to make it a permanent part of your fleet. The leasing company undertakes the responsibility of purchasing and owning the vehicle, and they expertly calculate its anticipated residual value at the lease’s end based on a projection of the kilometers you expect to travel.

This residual value plays a crucial role in determining your monthly lease payments, as it represents the estimated worth of the vehicle after the lease duration. The difference between the initial purchase price and this residual value comprises the basis for your monthly lease cost.

There are two primary styles of lease agreements that cater to the varied needs of lessees, each designed to offer different advantages and flexibility depending on the specific requirements of your business. Understanding these options can help you make an informed decision about which leasing style best suits the demands of your farming operations.

Here are a couple of common options.

- Fixed term and fixed km operating lease eg: 36 months for 75000km where you hand the vehicle back in 3 years in good condition. This is a straight rental agreement.

- Finance Lease: This is the option businesses choose when they have the intention of owning the asset at the end of the lease term. In this situation, there is a fixed term with a known residual.